The past few weeks have seen lots of ups and downs in the cryptocurrency markets. In particular, one decentralized finance (DeFi) project called Yearn Finance and its YFI governance token experienced some truly jaw-dropping volatility – leaving many investors scratching their heads. Let’s take a closer look at what happened.

What is Yearn Finance?

Yearn Finance is one of the major decentralized finance (DeFi) protocols that allows users to earn yield on their cryptocurrency holdings. Using “vaults” that automate strategies across multiple protocols, Yearn aims to optimize returns for depositors. The project launched in 2020 and was for a time one of the largest DeFi platforms by total value locked.

Yearn Finance runs on the Ethereum blockchain and its native governance token is called YFI. Holders of YFI are able to vote on protocol upgrades and changes. With a market cap hovering around $200 million for much of 2023, YFI is a top 150 cryptocurrency by value.

The Wild Ride Begins

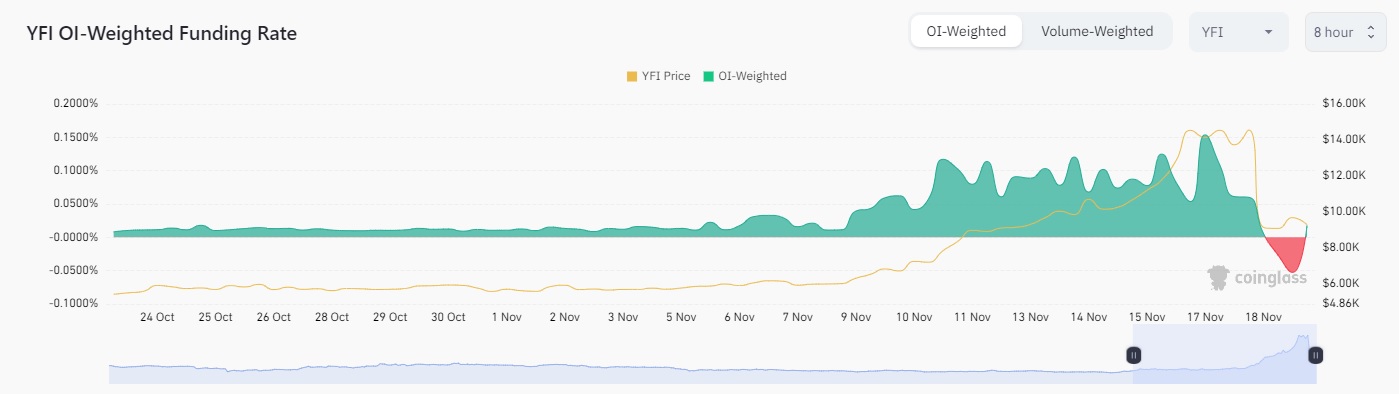

In mid-November, YFI prices started an impressive rally, gaining over 170% in just nine days. However, the good times didn’t last long. In a truly stunning reversal, YFI shed 43% of its value within just five hours – wiping out around $190 million in market value.

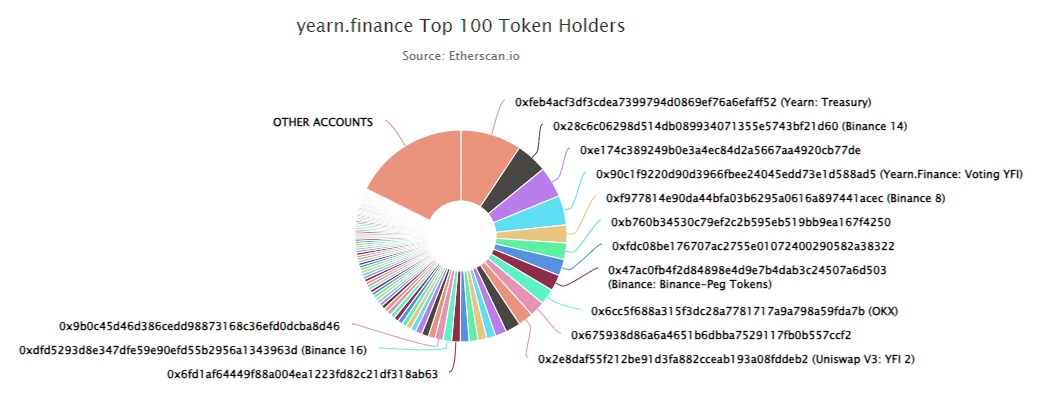

This collapse liquidated nearly $5 million in crypto trader positions held on exchanges like Binance. Underneath this massive selloff, rumors began to swirl about a coordinated exit scam being carried out by developers due to the concentration of YFI holdings. Had one of the biggest projects in DeFi come to a screeching halt? Traders scrambled to make sense of the turmoil.

Damage Control

In the aftermath, Yearn Finance founder Andre Cronje took to Twitter to ensure the community that no exit scam had taken place. He argued that concentrated token holdings are not evidence of ill intent, and the project remained operational as always. Still, user funds on the platform did see $6 million drained during the chaos according to DeFi Pulse.

Meanwhile, a conspiracy theory took hold that the wild YFI swings were caused by manipulation from well-capitalized traders deliberately shorting the token. Whether the price crash was a purely technical movement or deliberate attack remains unclear. As the dust settled, YFI managed to stabilize in the $9,300 range – still a huge gain from prior levels despite the mayhem.

A Broader Context

This wasn’t the only disturbance in the DeFi sector recently. In perhaps an unfortunate coincidence, another major protocol called dYdX also claimed to be the “victim of a targeted attack” around the same time. Its founder argued that manipulation of the entire YFI market was involved.

For retail investors, events like these highlight the high risks still present in the largely unregulated crypto market. While DeFi aims to be transparent and community-driven, black swan events may continue to zap confidence in even top projects. As always, responsible risk management is key.